45 government zero coupon bonds

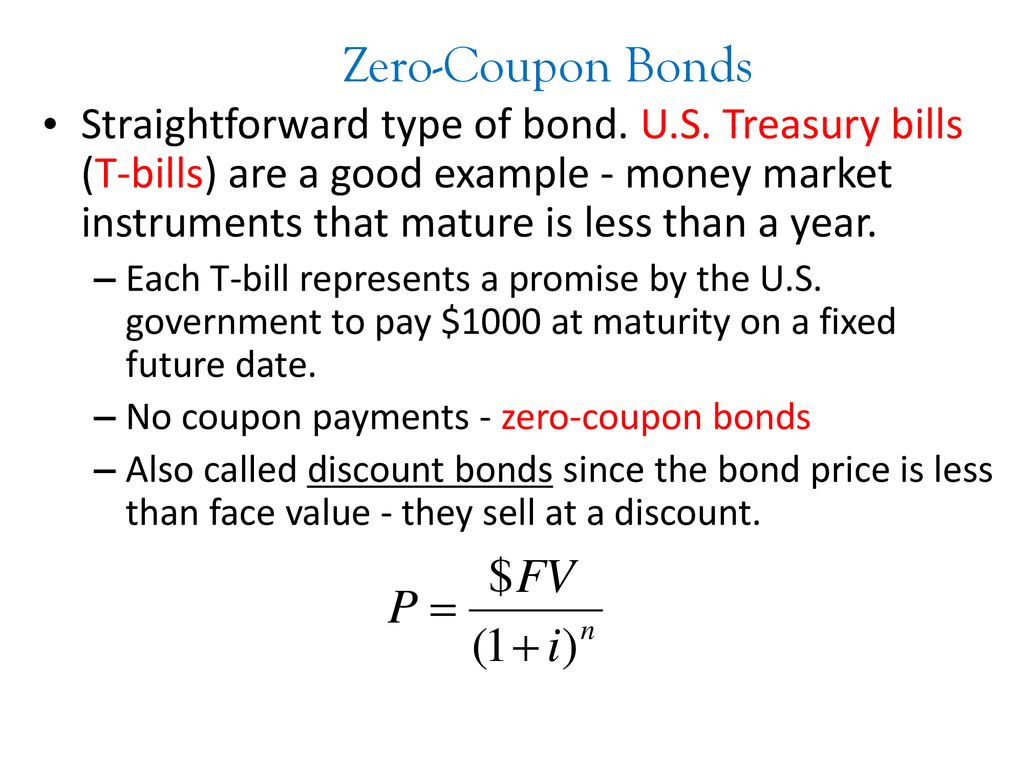

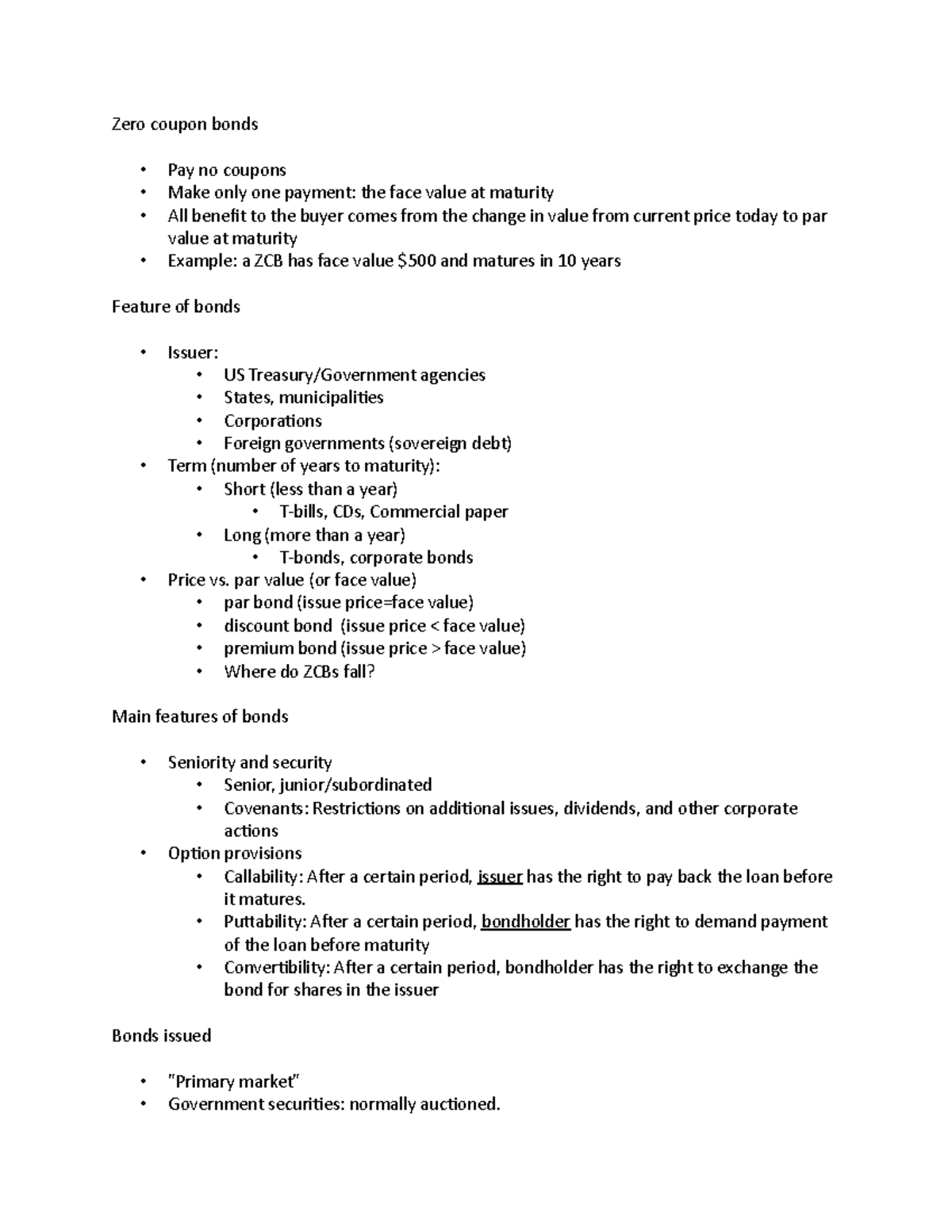

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... › government-bondsGovernment Bonds: Types, Benefits & How to invest - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage account .

Government zero coupon bonds

› newsLatest Business News | BSE | IPO News - Moneycontrol Nov 07, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › market-data › bondsBonds & Rates - WSJ Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes.

Government zero coupon bonds. en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% of the $20,000 each year. › market-data › bondsBonds & Rates - WSJ Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › newsLatest Business News | BSE | IPO News - Moneycontrol Nov 07, 2022 · Latest News. Get all the latest India news, ipo, bse, business news, commodity only on Moneycontrol.

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "45 government zero coupon bonds"