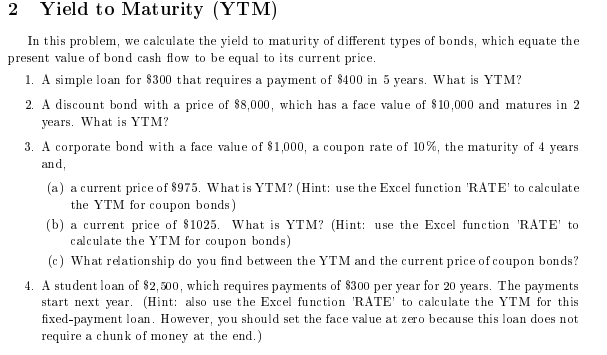

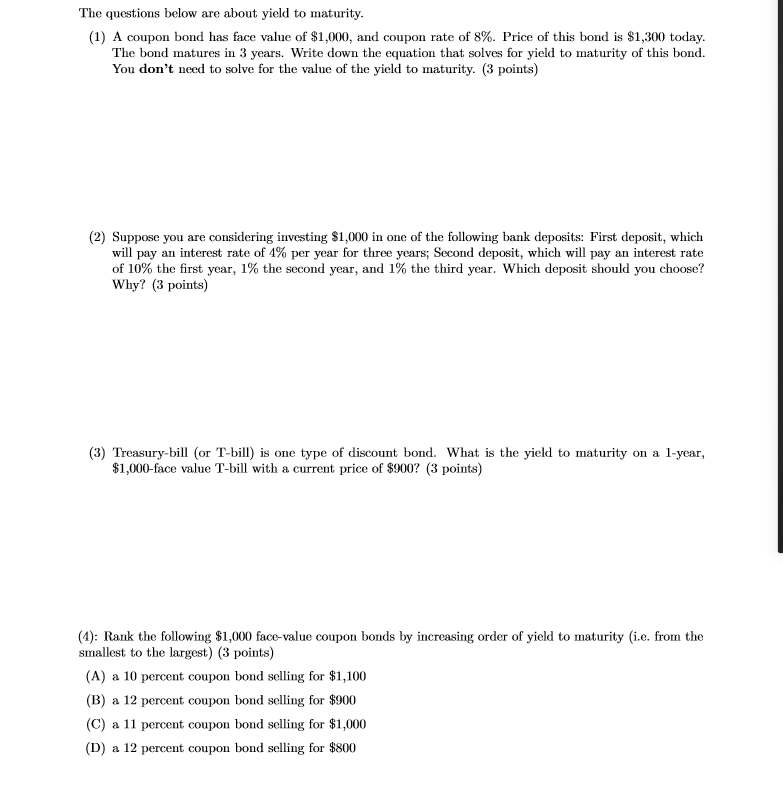

43 yield to maturity coupon bond

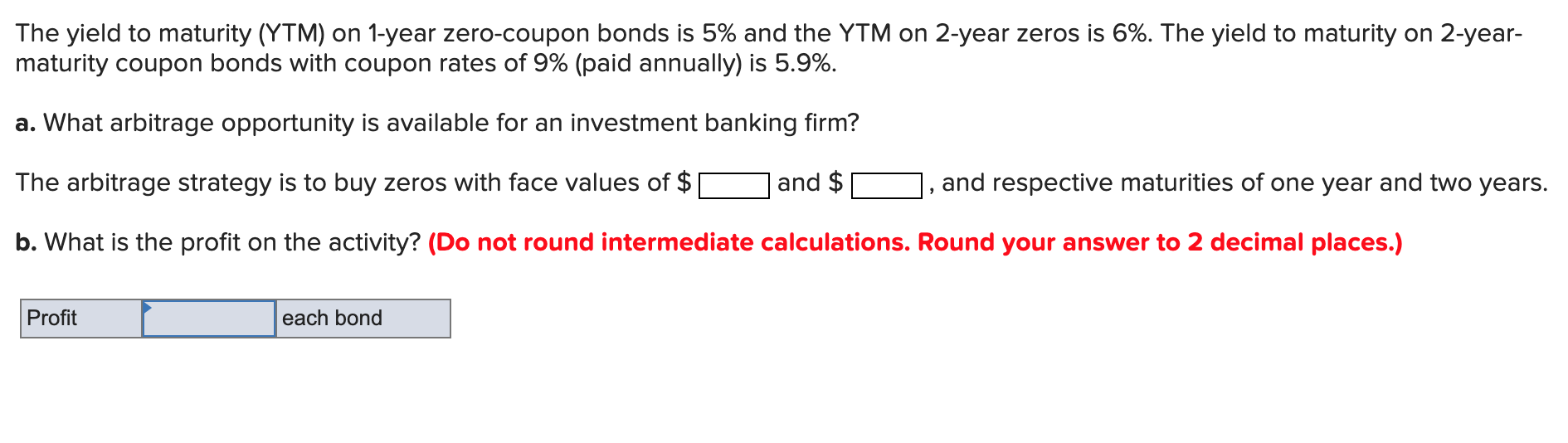

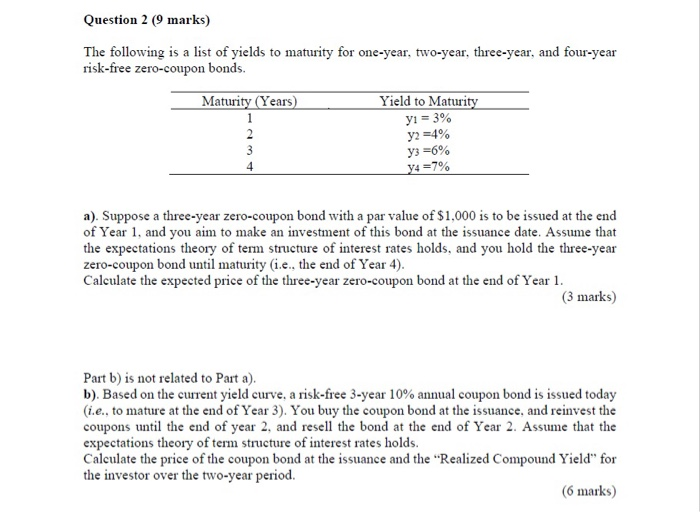

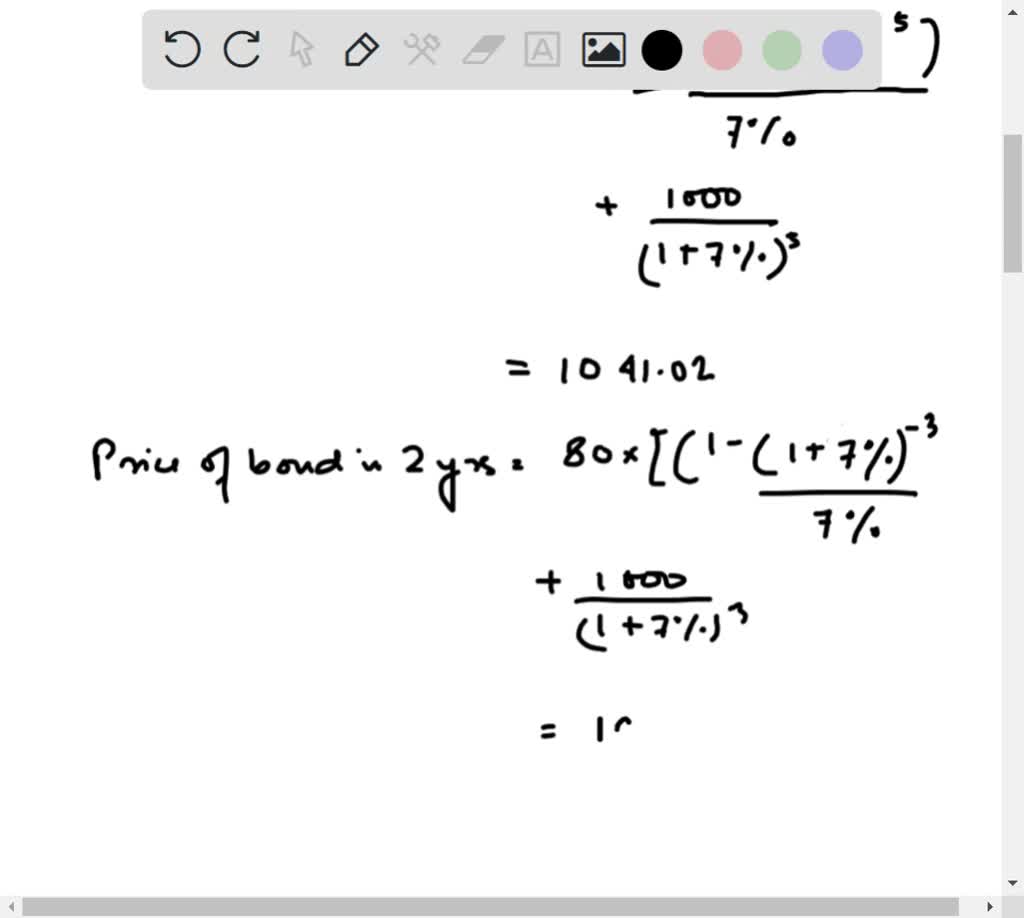

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

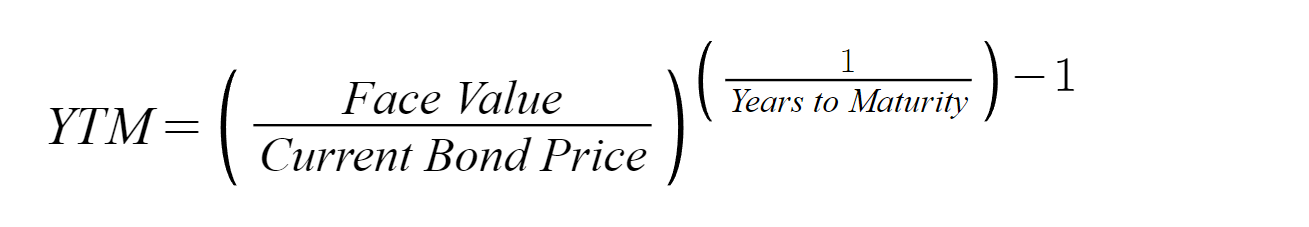

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to maturity coupon bond

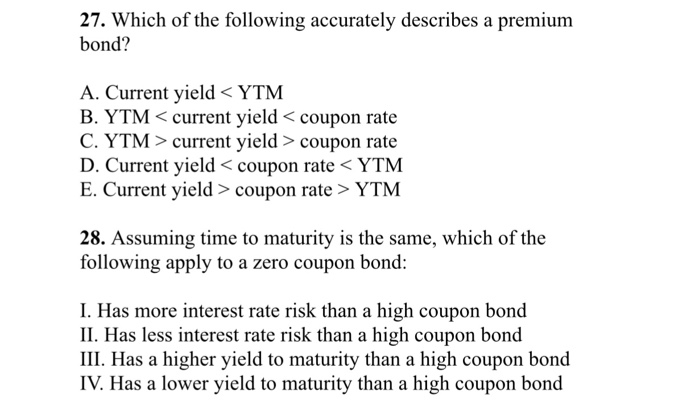

When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · When a Bond's Yield to Maturity Equals Its Coupon Rate . If a bond is purchased at par, its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by ... Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Yield to maturity coupon bond. Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · When a Bond's Yield to Maturity Equals Its Coupon Rate . If a bond is purchased at par, its yield to maturity is thus equal to its coupon rate, because the initial investment is offset entirely by ...

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![PDF] Yield to Maturity Is Always Received as Promised: A Reply](https://i1.rgstatic.net/publication/228510503_Yield_to_Maturity_Is_Always_Received_as_Promised_A_Reply/links/00b7d5182ee3b9fafb000000/largepreview.png)

Post a Comment for "43 yield to maturity coupon bond"