42 treasury zero coupon bond

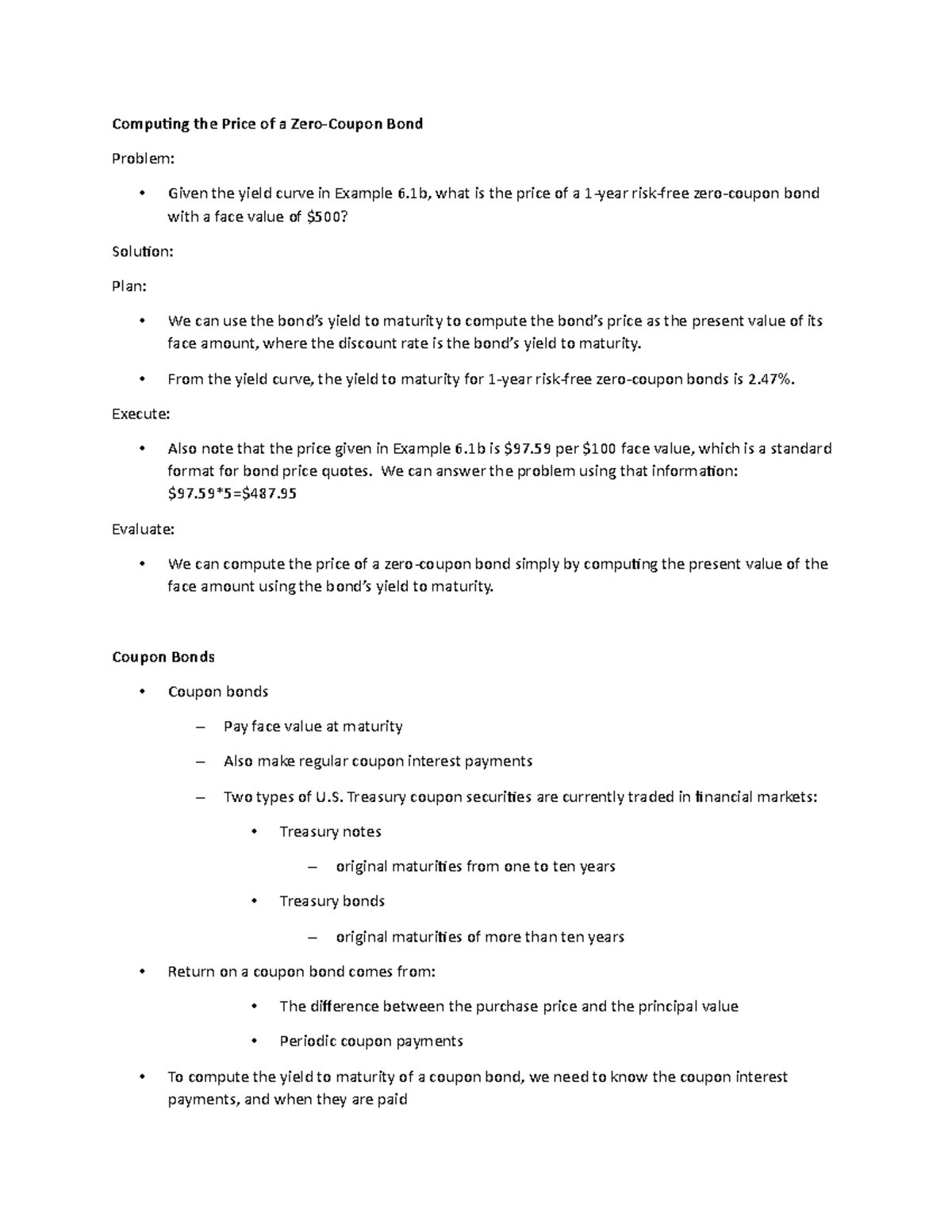

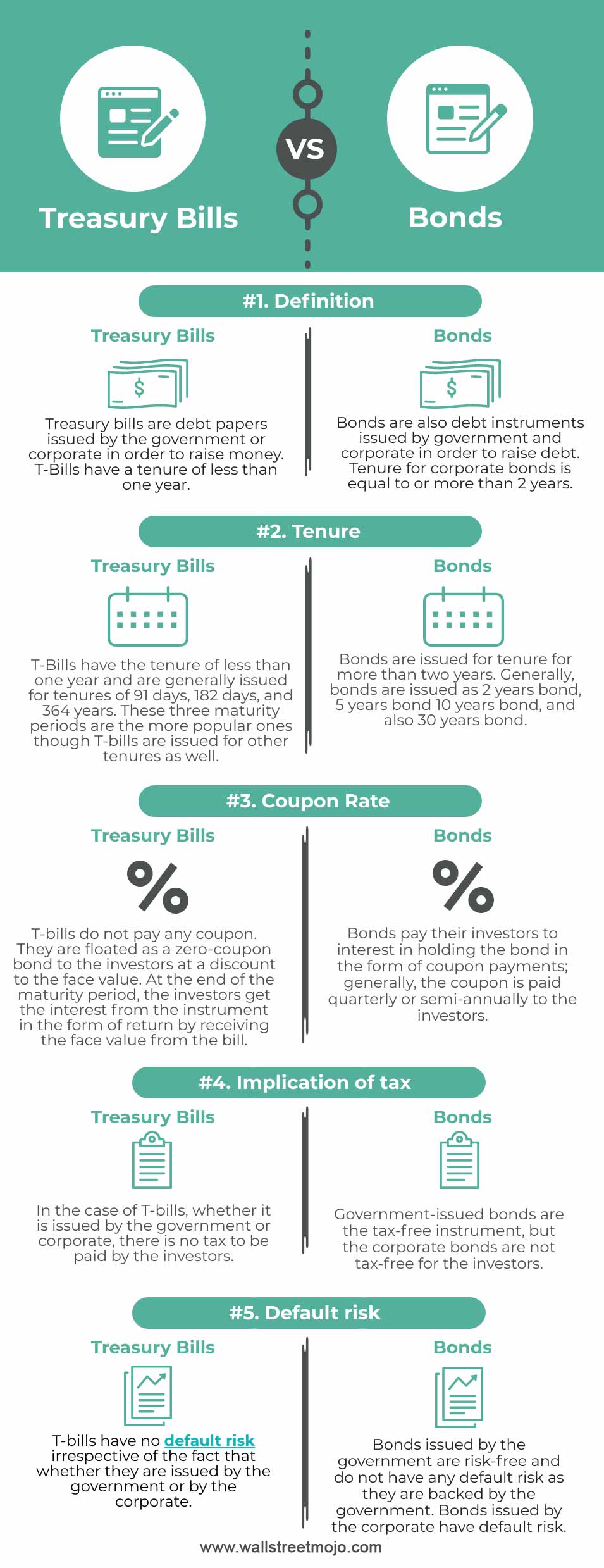

Should I Invest in Zero Coupon Bonds? | The Motley Fool For instance, a 10-year Treasury bond might have a coupon rate of 3%, meaning that each $1,000 face-value bond will make interest payments totaling $30. ... Zero coupon bonds are therefore sold at ... › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

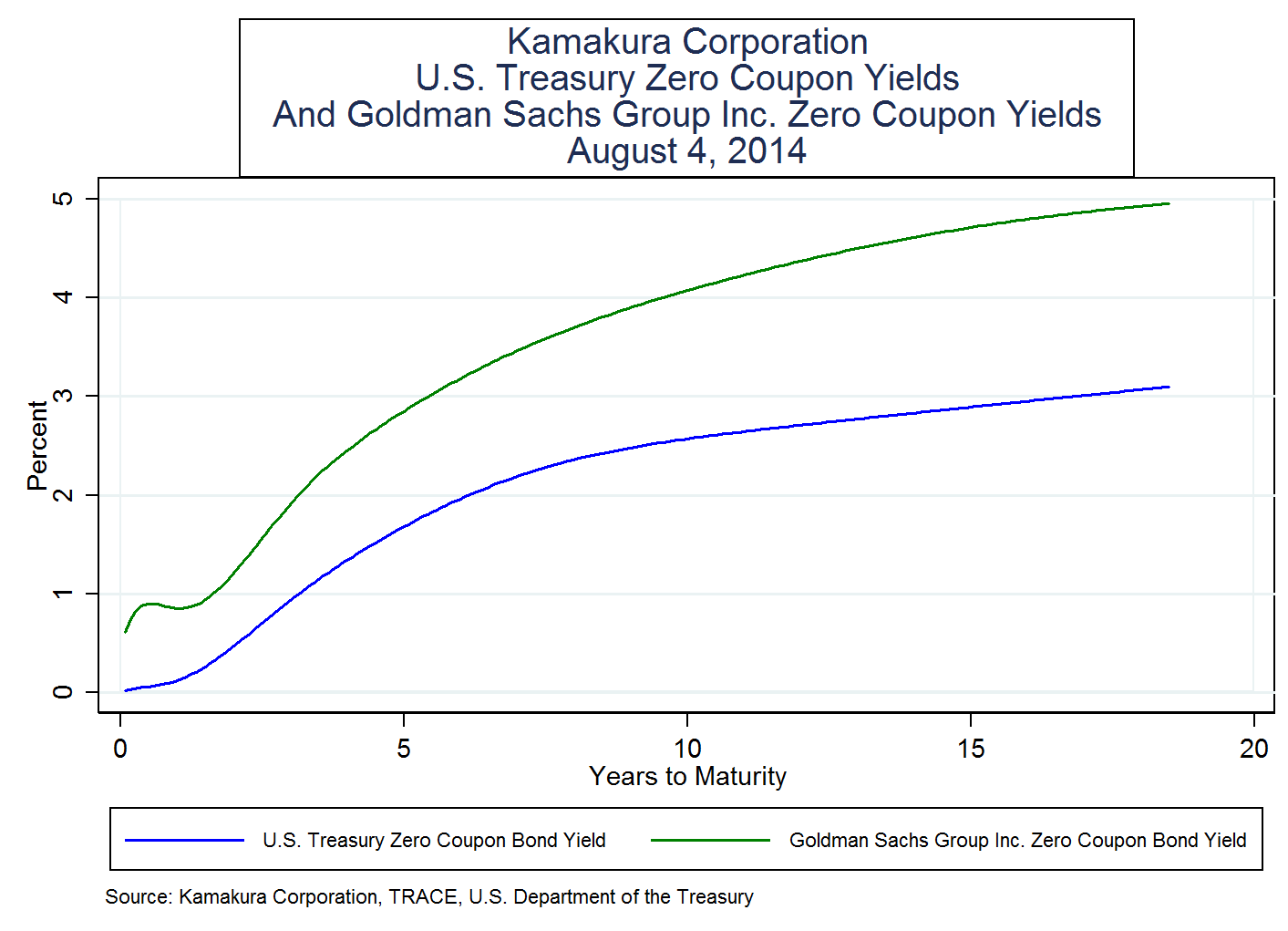

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury zero coupon bond

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Treasury zero coupon bond. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds are issued by the Treasury Department, corporations and municipalities. The bonds are considered a low-risk investment compared to stocks, commodities and derivatives.... Managing Risk With Fixed Income: How to Buy Zero Coupon Bonds Speaking of taxes, Treasury income is exempt from state income tax but not Federal. During the economic crisis of 2008, there were many people who made a fortune in Treasury Bonds. Their long-term Treasury position became very valuable as the Federal Reserve lowered rates down to zero. As interest rates go down, the value of those bonds go up! Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Treasury Coupon Bonds - Economy Watch Zero coupon bonds are bonds that do not come with interest payments. Rather, the bonds are sold at prices lower than face value and their redemption is on par with the face value. Some fixed income securities such as US Savings bonds and US Treasury Bills are zero coupon bonds. Zero Coupon Treasury Bonds (STRIPS) - Financial Web Zero coupon bonds are essentially the same product as all Treasury bonds, but they are paid out in a different manner. Essentially, instead of receiving the interest payments on the bond during the life of the bond, which is typical, the investor will receive the payment in full when the bond matures. This creates a product different from ... How to Invest in Zero-Coupon Bonds - US News & World Report PIMCO 25+ Year Zero Coupon US Treasury ETF (ticker: ZROZ ), an exchange-traded fund containing zeros with long maturities, yields about 2.7 percent. While that's not terrible compared to many... 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund - PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund Share ADD PRINT SUBSCRIBE US Treasury Sector 2.60% distribution yield As of 09/30/2022 3.32% 30-day sec yield As of 10/14/2022 -42.00% nav ytd return As of 10/14/2022 -41.98% MARKET PRICE YTD RETURN As of 10/14/2022 Overview Fees & Expenses Yields & Distributions Prices & Performance

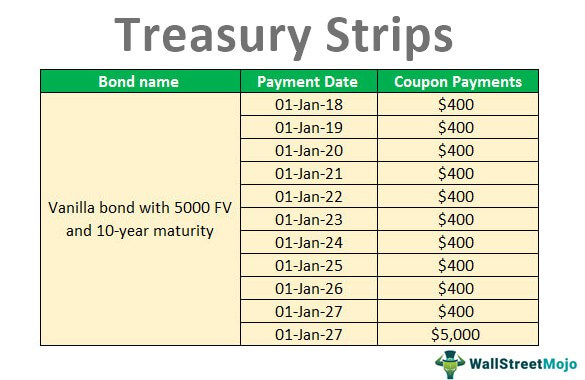

What are US "Treasury zeros" (STRIPS)? - Pecunica™ Zero-coupon notes and bonds are not issued by the US Treasury . Instead, "Treasury zeros " are created by financial institutions and government securities brokers and dealers through the Treasury's STRIPS program. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money . The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year.

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 treasury zero coupon bond"