38 coupon vs zero coupon bonds

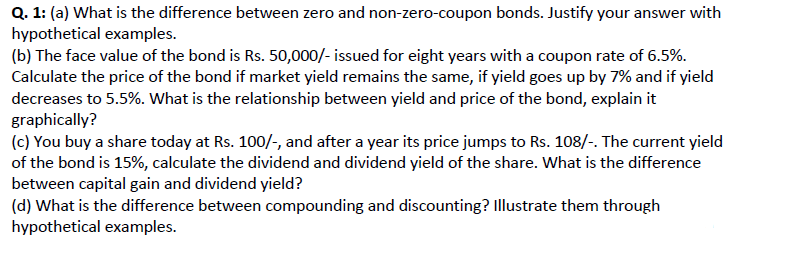

About Discount Bonds versus Zero Coupon Bonds - Accounting V17 - Confluence Zero Coupon bonds generally have a Maturity Date that is more than a year and a half out from the issue date. Unlike discount bonds, Zero Coupons do take compounding into account, and are generally issued with a semi-annual compounding yield; therefore, they have a Payment Frequency equal to the standard payment frequency of semi-annual. Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

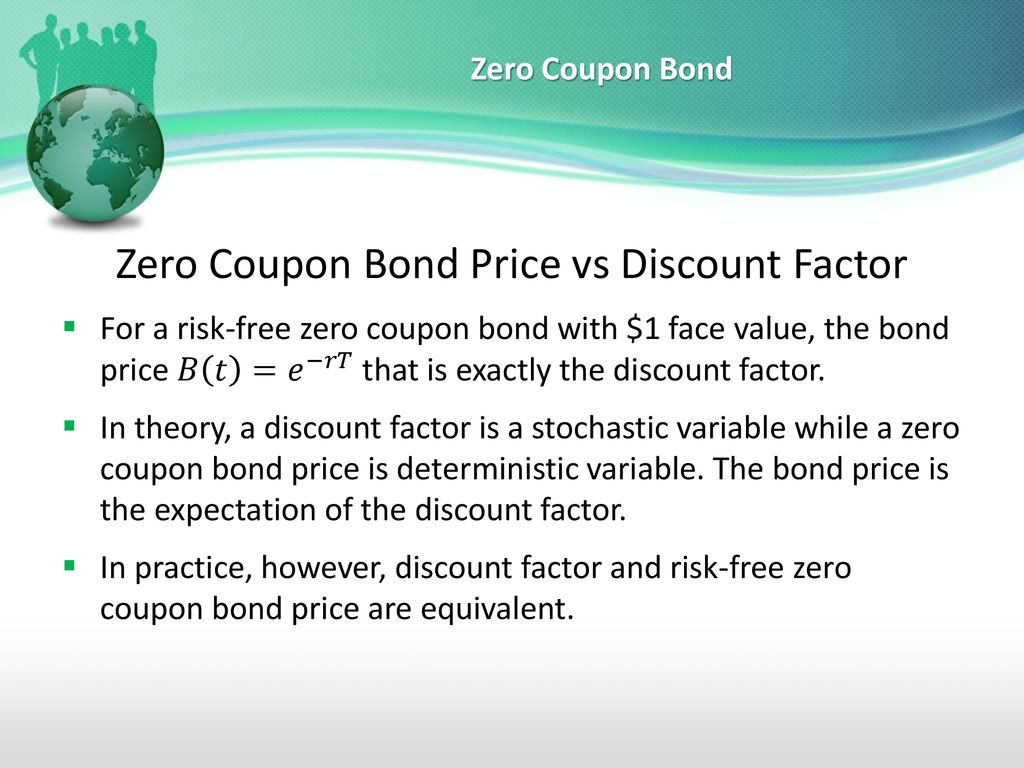

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Coupon vs zero coupon bonds

Explain Zero Coupon Bonds versus Coupon Bonds - QS Study The zero coupon bond contrasts with the coupon bond, and is the most straightforward of all bonds. The face of the certificate has the name of the investor, the nominal (face) value and the maturity date. It is issued at a discount rate, which reflects the interest rate that the investor is prepared to pay, i.e. the market rate for 3-year money. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and... What's the difference between a zero-coupon bond and a Treasury ... - Quora Zero coupon bonds are the same, ONLY, they are issued at a discount price in comparison with their face Value with 0% interest per year. Hence it would be 500, 0% bonds, Purchased for Rs. 850 (which Continue Reading Sanjay Prajapati

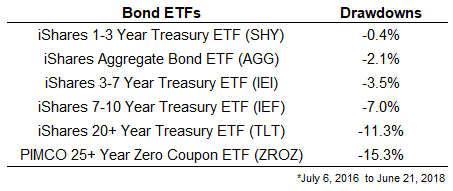

Coupon vs zero coupon bonds. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep In contrast, for zero-coupon bonds, the difference between the face value and the bond's purchase price represents the bondholder's return. Due to the absence of coupon payments, zero-coupon bonds are purchased at steep discounts from their face value, as the next section will explain more in-depth. Zero-Coupon Bond - Bondholder Return Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. 5 Sept 30.ppt - • Bond Pricing (cont.) • Pricing a Zero Coupon Bond ... •Yield to Maturity • Bond's internal rate of return • The interest rate that makes the PV of a bond's payments equal to its price; assumes that all bond coupons can be reinvested at the YTM • Current Yield • Bond's annual coupon payment divided by the bond price • For premium bonds: Coupon rate > Current yield > YTM • For discount bonds: Coupon rate ... Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Deep Discount bonds and Zero Coupon Bonds - The Fixed Income Deep Discount bonds and Zero Coupon Bonds. In 1992 investors were drawn to exciting advertising by Industrial Development Bank of India (IDBI), a Central Government promoted Development Financial Institution, calling for subscription to its Flexi-Bonds. The terms were mouth-watering, offering bonds with a face value of Rs. 1 lakh for Rs. 2,700. Zero-Coupon Bonds and Taxes - Investopedia The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons. A regular bond pays interest to bondholders, while a zero-coupon bond does not... What is the difference between a zero-coupon bond and a regular ... - Quora Simple, zero coupon bonds are sold at significantly lower prices or at deep discounts- say a bond with a face value of $1000 will sell for lower than its face value say $750. So at maturity while the investor would not receive any interest, he will receive the full face value of the bond. Profit=$1000-$750=$250 (Numbers are meant purely

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Coupon bonds pay interest or coupon in predetermined intervals throughout the bond's duration or time to maturity. Zero coupon bonds do not pay any coupon or interest throughout the duration of the bond. Instead, these are sold at a discount to face value and redeemed at face value upon reaching maturity. 7 Best Passive Investment Strategy qer.solenjoie.fr Bonds directly linked to interest rates include fixed rate bonds , floating rate bonds , and zero coupon bonds . Convertible bonds are bonds that let a bondholder exchange a bond to a number of shares of the issuer 's common stock. Exchangeable bonds allows for exchange to shares of a corporation other than the issuer. panne frequente volvo ... Zero Coupon Bonds Explained (With Examples) - Fervent The interest rate (aka yield) of zero coupon bonds tends to be higher than the interest rate of say, straight / vanilla bonds. And that's ultimately because for the most part, zero coupon bonds tend to be riskier securities. The higher interest rate / higher yield is meant to compensate for, or pay for, the higher risk. How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy

What's the difference between a zero-coupon bond and a Treasury ... - Quora Zero coupon bonds are the same, ONLY, they are issued at a discount price in comparison with their face Value with 0% interest per year. Hence it would be 500, 0% bonds, Purchased for Rs. 850 (which Continue Reading Sanjay Prajapati

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

Explain Zero Coupon Bonds versus Coupon Bonds - QS Study The zero coupon bond contrasts with the coupon bond, and is the most straightforward of all bonds. The face of the certificate has the name of the investor, the nominal (face) value and the maturity date. It is issued at a discount rate, which reflects the interest rate that the investor is prepared to pay, i.e. the market rate for 3-year money.

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "38 coupon vs zero coupon bonds"