38 present value of coupon bond

How to Calculate PV of a Different Bond Type With Excel The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Present value of coupon bond

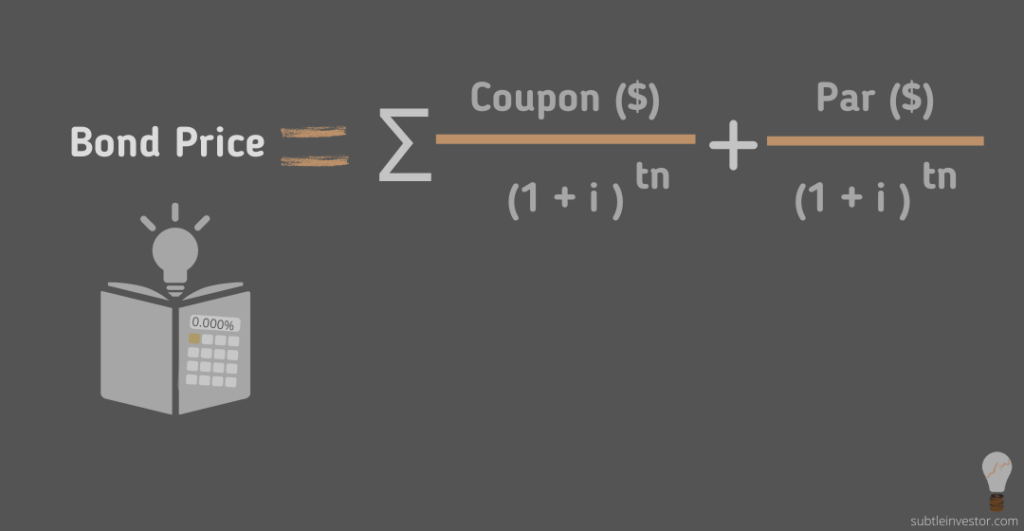

What Is Bond Valuation? - The Balance The current value of a bond is determined at any point by totaling expected future coupon payments and adding that to the present value of the amount of principal that will be paid at maturity. Accurately determining a bond's value is necessary to decide whether it is a good investment, but it's not a simple process. Excel formula: Bond valuation example | Exceljet In the example shown, we have a 3-year bond with a face value of $1,000. The coupon rate is 7% so the bond will pay 7% of the $1,000 face value in interest every year, or $70. ... The value of an asset is the present value of its cash flows. In this example we use the PV function to calculate the present value of the 6 equal payments plus the ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. ... As mentioned above, the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price equation below:

Present value of coupon bond. Zero Coupon Bond Calculator - What is the Market Value? What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds Bond Price Calculator - Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Bond Valuation Definition - Investopedia Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... How to Calculate the Price of Coupon Bond? - WallStreetMojo Next, determine the present value of the first coupon, second coupon, and so on. Then, determine the present value of the par value of the bond. ... Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective ...

c) Calculate the Present Value of a zero-coupon bond | Chegg.com Find the duration of the zero-coupon bond. an. Question: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an. Solved What is the present value of a zero-coupon bond with | Chegg.com What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 b. R744 094 c. R742 470 d. R861 667. Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... OK, well, if the coupon payments are for 10% and then the market interest rates fall from 10% to 8%, then that bond at 10% is valuable, right. It is paying 10% while the overall interest rate is only 8%. Exactly how much is it worth? You mean 'what is the present value of a bond?' How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper.

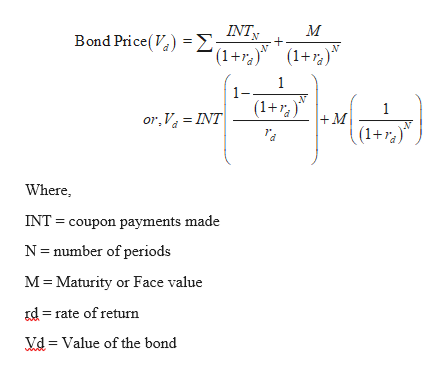

Valuing Bonds | Boundless Finance Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. Bond Price Formula: Bond price is the present value of coupon payments and the par value at maturity. F = face value, iF = contractual interest rate, C = F * iF = coupon payment (periodic interest payment), N ... Calculating the Present Value of a 9% Bond in an 8% Market The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. It is reasonable that a bond promising to pay 9% interest will sell for more than its face value when the market is expecting to earn only 8% interest. What is a Bond Valuation? | Learn More | Investment U In this example, the present value of coupon payments would be $399.27 and the present value of the par value is $680.58. This bond trades at a premium to its par value—rightfully so, since it has a higher interest rate than the current prevailing rate. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of ...

Answered: A 25-year coupon bond pays an annual… | bartleby Solution for A 25-year coupon bond pays an annual coupon of 5 and has a face value of 100. If the current price is 100, what is the yield to maturity close. Start your trial now! First week only $4. ... Present Value is the value of money in today at zero period for all the payments which is received ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

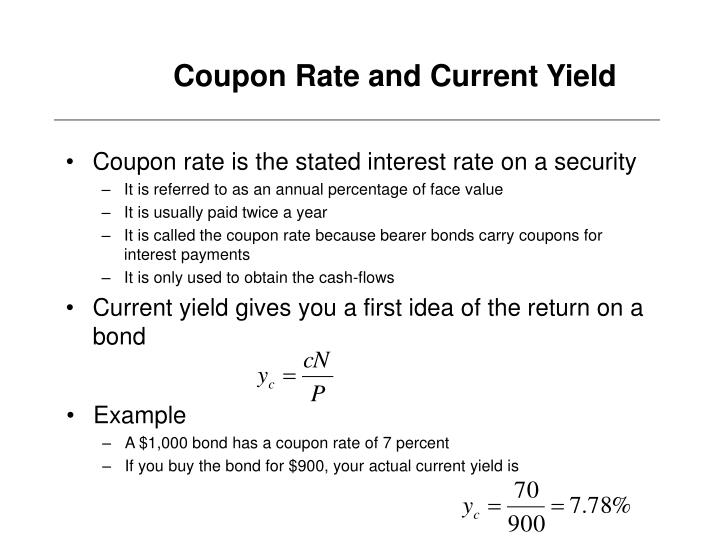

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

8. Calculate the present value of a bond that pays a coupon rate of 3% ... Calculate the present value of a bond that pays a coupon rateof 3% per year for 10 years, and matures in 10 years at its facevalue of $1000, using each of the following current market interestrates as the discount rate: (a) 2%;Show your calculations. (b) 3%Show your calculations.; (c) 5%. Show your calculations.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments. equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Post a Comment for "38 present value of coupon bond"